Businesses in all businesses should take some opportunity to set up an IT asset disposition (ITAD) strategy. However, this endeavor is particularly crucial for businesses in the financial services sector. Formulating an ITAD program may also be harder for businesses within this sector because they face numerous challenges that businesses in other sectors don’t. Despite these struggles, financial businesses must put an ITAD strategy in place when possible.

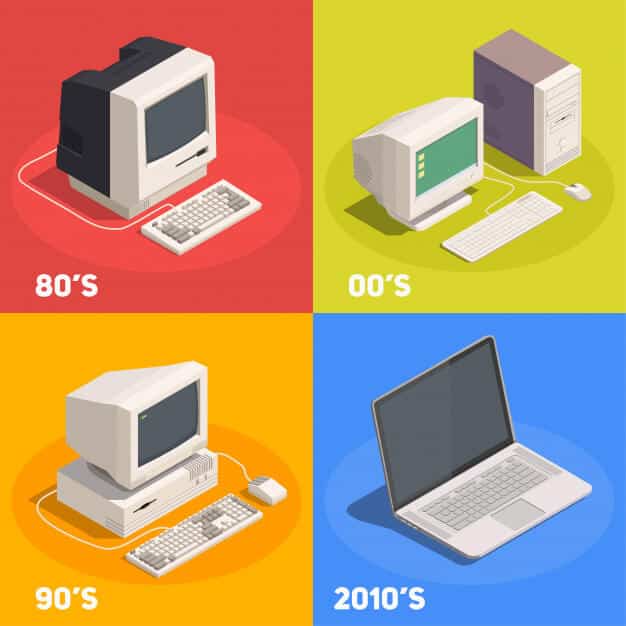

The finance industry today is fully technology-driven, and we see IT-related equipment everywhere in the financial-industrial premises. There are various uses for these, and every part of the financial industry uses technology-driven equipment for every one of its day-to-day activities.

As technology is the real driving force for the financial industry, we can see the devices running with various technologies helping the present-day financial industry executive with every task at his hand.

Today we see that the IT and related equipment are occupying most of the offices running financial-related activities. When this technology-based equipment reaches its useful life cycle, these financial companies face many problems while disposing of these devices safely and securely.

Most of the organizations offering finance-related services have a wide operation area and are operating through their multi-locational branch offices. In this type of organization, the head office decides on how the end-of-life IT equipment is disposed of. Usually, branch-level disposal decisions are infrequent.

As technology is fast advancing so is the need for more powerful IT equipment and devices to deal with every growing complex financial operation.

When a financial analyst working in a financial institution determines that the equipment he is using has become outdated or other improved versions of the equipment are available, his office has to quickly take off the existing IT equipment and give him the latest one.

Thus, the change of equipment takes place at least once in three years even though this equipment will have more life left in them. Due to this, a lot of equipment is retired from active service even before reaching the end of the life cycle period.

This leads to a complicated and complex situation for the financial institutions as they are burdened with the task of finding and procuring the best available equipment for their day-to-day use. In addition to this, they have to find the right ways of disposing of the excess IT assets.

The problems are compounded many folds because these IT assets are to be disposed of containing sensitive data of the company and its customers, and they need to be protected at any cost.

When these data reach unauthorized persons’ hands, it is likely to cause many problems to the financial company. Hence it cannot just dispose of the old equipment just like that as old furniture or used up stationery items.

-

Laws Governing ITAD In The Financial Industry

Gramm-Leach-Biley Act: Orders all financial industry companies to safeguard sensitive data when the data is stored in their IT assets until those assets are sent for destruction. Due to this, financial companies are lawfully committed to erasing sensitive data to prevent unauthorized reading or reconstruction. Financial companies are also expected to regularly evaluate their ITAD plan, with the intent to identify measures to enhance them; if an error in the plan is identified, then the company must get it rectified immediately.

Dodd-Frank Wall Street Reform & Consumer Protection Act: This law prevents financial industry companies from making false statements to their customers about their company operations. So, financial companies must share with their customers their ways of destroying their customer’s sensitive data.

E.g., a financial company gives a specific timeline for completion of their customer’s data destruction. The company should comply with the set timeline, and if there is any delay, then the concerned customer should be duly informed regarding the same or else the concerned customer would think that their data is destroyed as per the informed timeline which results in the financial company’s statement given to the concerned customers a false one.

Breaking one of these acts can point to large fines, which is why it’s so essential to ascertain an ITAD plan.

Financial companies have to follow a structured system while disposing of the surplus IT assets and have to go through the following steps:

-

The IT Assets Disposal Team Must Understand The Necessity For Proper Disposal:

IT assets disposal is one of the crucial functions of any financial institution. The management must educate the team of its staff looking after the IT Assets disposal as to the importance of scientific and safe IT assets disposal. They should also train them about the statutory regulations in this respect and the legal compliance they have to satisfy concerning the proper disposal of the used IT assets.

They must learn the safe and secure processes involved in the operations of their company. They should also be aware of all the services they are offering and the role of each of the equipment as they are now attempting to dispose of. With this knowledge, they must be able to segregate the equipment that can be disposed of without any data removal process and the ones that must be subject to stringent data removal processes to ensure 100% data security.

Towards this, they must be able to identify the lead person or the leadership team that is overlooking the entire IT assets disposal function and at which level the process is taking place inside the organization. They must also be able to identify the data-bearing devices and must put in place the right plan for their safe disposal. While doing so, they must adhere to their corporate policies.

The IT Assets disposal team in your financial institution must comply with the FACTA provisions’ requirements in the Fair Credit Reporting Act. They should also have sound knowledge about the Financial Industry Regulatory Authority and the requirements for safe IT Assets disposal in the Gramm-Leach-Bliley Act.

The above compliance is necessary for safeguarding their consumer’s private data. If there is any violation, the company will be subjected to heavy penalties and criminal proceedings leading to loss of brand reputation and business loss.

Due to this, it is necessary to consider all the relevant facts and legal regulations before appointing a person as your ITAD partner.

-

Decide What Is Good For You: Reselling, Reusing, Or Buyback Of Equipment

You cannot think of saving money at the cost of losing your sensitive data. Your IT Asset disposal team must have all the necessary data to decide on the equipment that is to be resold and repurposed so that it can be used for some more time by others.

They must make sure that these equipment are all free of sensitive financial data before they leave their hands, or they will be treated so by their ITAD partner before these equipment are sent out of their control.

If your policies dictate that the hard disks and other data storage devices must be handled and disposed of in a particular manner, that must be followed without any deviation.

Your ITAD partner must advise you on the best ways to deal with other specialized equipment for reselling them. If they find that there is no repurchasing market for this equipment, these must be disposed of off in a fully scientific manner following environmentally friendly ways.

-

Make Ready Back-Up Systems And Be Prepared For Data Recovery Before Starting The ITAD Process

Before starting the ITAD process, the financial company must have a fail-proof disaster recovery plan and a backup plan. This helps you in dealing with any emergencies that may arise due to improper data handling. It will help you in saving any sensitive transaction and loss of financial or customer data. You must make sure that all the backups of the data in the Assets to be disposed of are safely stored in redundant storage systems.

-

Importance of StarPc In Your Financial Company’s IT Assets Disposal:

Normally it is not possible to do the entire functions that are necessary for the IT Assets disposal by your company alone without taking assistance from others. This is just not possible for you to dispose of them properly. For this, you need to have a good ITAD partner like StarPc Excess to work with you in close association.

Apart from this, you must also take the help of those people who have specialized tools and procedures to help you complete these processes in a hassle-free manner. Most of the time, good ITAD partners like StarPc Excess work with many types of purchasers and suppliers in different markets to complete the disposal process.

So, it is necessary for you also to know who are the people who will be taking your Assets for reselling and those who are taking them for final disposal; at StarPc Excess, we specialize in reselling and final disposal of your financial IT assets.

Thus, a financial company must be more careful while trying to dispose of their used IT assets and closely work with their ITAD partners. This is necessary to safeguard the interests of the company as well as that of their customers.

Relevant Resources:

How ITAD Services Can Help Your Company

How to Use ITAD as A BYOD Strategy for Protecting Your Corporate Data